Table of Contents

- THE WALT DISNEY CO. (DIS) Stock Price Evolution (USD) 1985-2023 # ...

- Disney Stock Split History

- Is Disney Stock a Buy After Earnings? | Morningstar

- Disney Stock Images : Free Disney Photos Royalty FREE Stock Images of ...

- Disney Stocks Soar as Analyst Claims “The Magic Is Back” | Disney Dining

- Disney stock - KylieTristan

- What's Going on With Disney Stock? | The Motley Fool

- Walt Disney Company’s Stock DROPS Under 0 During Earnings Call ...

- Disney stock market performance - credit default swap trade spread

- The Time To Buy Disney Is Now (NYSE:DIS) | Seeking Alpha

As one of the most recognizable and beloved brands worldwide, The Walt Disney Company has been a staple in the entertainment industry for nearly a century. With a diverse portfolio of businesses, including media networks, theme parks, and consumer products, Disney has consistently delivered magic to audiences around the globe. For investors, the Walt Disney Co. stock quote (U.S.: NYSE) is a closely watched indicator of the company's financial performance and future prospects. In this article, we'll delve into the world of Disney stock, exploring its current market trends, historical performance, and what it means for investors.

Current Market Trends

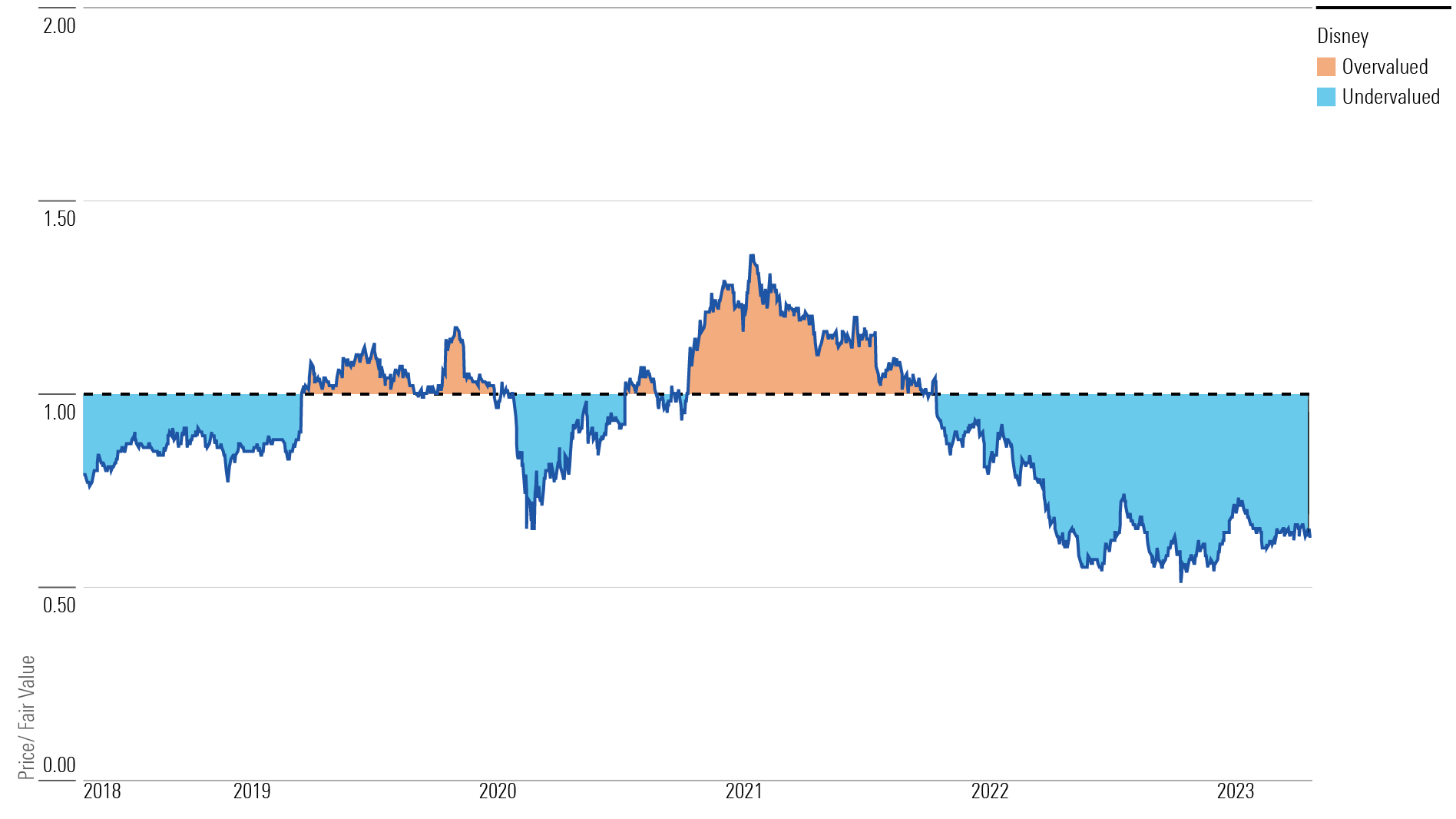

As of the latest market update, the Walt Disney Co. stock quote (U.S.: NYSE) is trading at around $140 per share, with a market capitalization of over $250 billion. The stock has experienced a significant surge in recent years, driven by the company's successful expansion into new markets, including streaming services and international theme park developments. The launch of Disney+, the company's flagship streaming platform, has been a major catalyst for growth, attracting millions of subscribers worldwide and positioning Disney as a major player in the rapidly evolving streaming landscape.

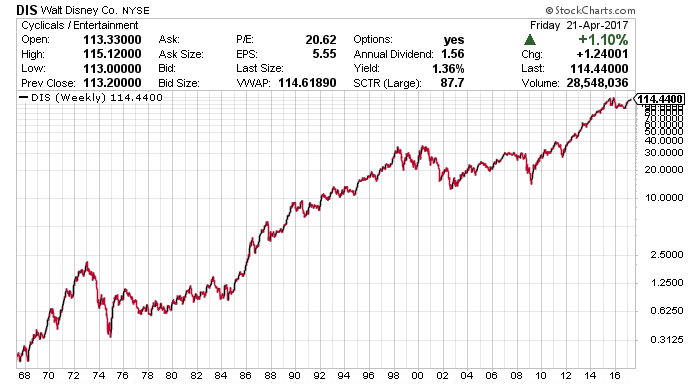

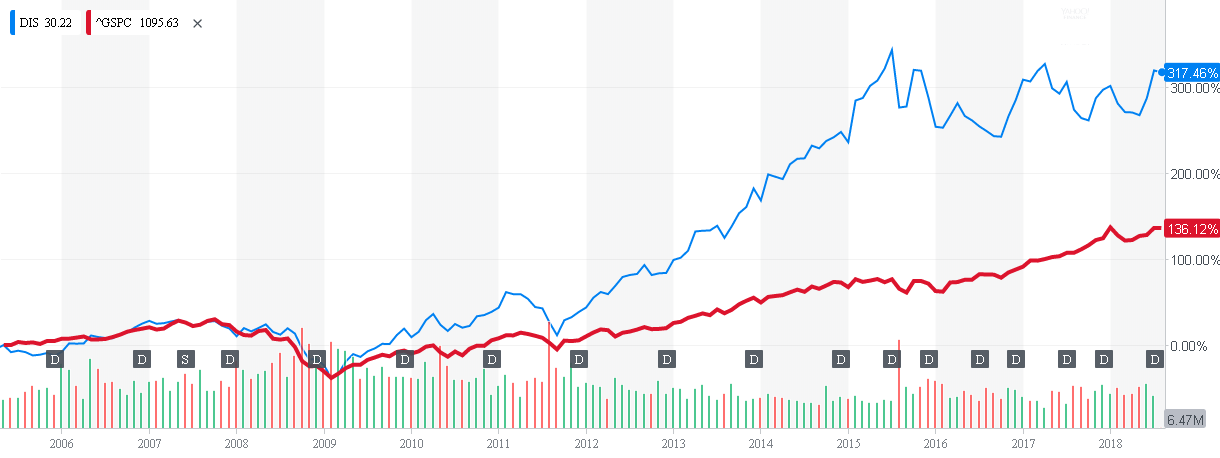

Historical Performance

A review of the Walt Disney Co. stock quote (U.S.: NYSE) over the past decade reveals a story of steady growth and resilience. Despite facing challenges from the COVID-19 pandemic, which impacted theme park operations and film production, Disney's stock has consistently outperformed the broader market. The company's diversification strategy, which includes a strong portfolio of brands such as ESPN, ABC, and Pixar, has helped mitigate risks and drive long-term growth. With a dividend yield of around 1.3%, Disney's stock also offers an attractive income stream for investors seeking stable returns.

Key Drivers of Growth

Several factors are expected to drive the Walt Disney Co. stock quote (U.S.: NYSE) in the coming years. These include:

- Streaming Services: The continued growth of Disney+ and other streaming platforms, such as Hulu and ESPN+, is expected to drive subscriber acquisition and revenue expansion.

- Theme Park Developments: Upcoming theme park expansions, including new attractions and lands, are anticipated to boost attendance and revenue at Disney's iconic resorts.

- Film and Television Production: A robust slate of upcoming films and television shows, including Marvel and Star Wars properties, is expected to drive box office success and licensing revenue.

In conclusion, the Walt Disney Co. stock quote (U.S.: NYSE) offers a compelling investment opportunity for those seeking a diversified portfolio with a strong track record of growth. With its iconic brands, expanding streaming services, and commitment to innovation, Disney is well-positioned to continue delivering magic to audiences and investors alike. As the company navigates the evolving entertainment landscape, investors can expect a thrilling ride, with potential for long-term growth and returns. Whether you're a seasoned investor or just starting to build your portfolio, the Walt Disney Co. stock is definitely worth considering.

Stay up-to-date with the latest Walt Disney Co. stock quote (U.S.: NYSE) and market trends on MarketWatch. Get real-time stock quotes, news, and analysis to inform your investment decisions and unlock the magic of Disney's financial performance.