Table of Contents

- SGA Home Security - Google Play 앱

- Petition · Stop the SGA Organizational Changes Without Student Input ...

- Sga logo creator Vectors & Illustrations for Free Download | Freepik

- The 3 Advantages of SGA. Being the most powerful game guild… | by Super ...

- SGA passes legislation, introduces new scholarship - WKUHerald.com

- SGA – Slavic Gospel Association

- SGA

- Understanding the Basics - ppt download

- Student Government Association Representation

- EDITORIAL: SGA doesn't serve its students - The Maroon

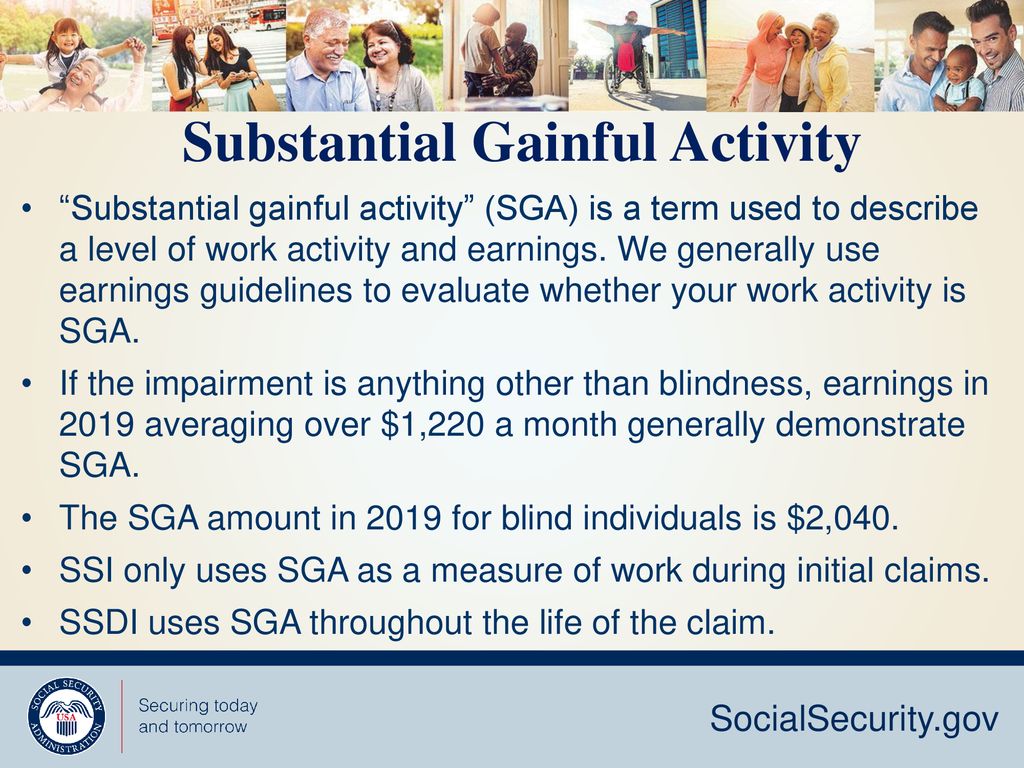

What is Substantial Gainful Activity?

SGA Income Limit for 2023

How Does the SGA Income Limit Affect Disability Claimants?

The SGA income limit plays a crucial role in determining an individual's eligibility for disability benefits. If an individual is earning above the SGA income limit, the SSA may deny their disability claim or terminate their existing benefits. However, if an individual is earning below the SGA income limit, they may still be eligible for benefits, depending on the severity of their disability and other factors.

Trial Work Period: An Opportunity to Test Your Abilities

The SSA offers a trial work period (TWP) that allows disability beneficiaries to test their ability to work without jeopardizing their benefits. During the TWP, which typically lasts for nine months, an individual can earn any amount without affecting their eligibility for benefits. This period provides an opportunity for individuals to explore their work capabilities and potentially return to the workforce without risking their benefits. In conclusion, understanding the Substantial Gainful Activity income limit is essential for disability claimants and beneficiaries. The SGA income limit serves as a benchmark to determine an individual's ability to engage in substantial work and earn a certain level of income. By familiarizing themselves with the SGA income limit and the trial work period, individuals can make informed decisions about their work and benefits. For more information and resources, visit the AARP website or consult with a disability expert.Keywords: Substantial Gainful Activity, SGA income limit, disability benefits, Social Security Administration, AARP, trial work period.

Note: The information provided in this article is subject to change, and it's always best to consult with the Social Security Administration or a qualified expert for the most up-to-date and personalized advice.