When it comes to determining disability benefits, the Social Security Administration (SSA) uses a variety of factors to decide whether an individual is eligible for benefits. One of the key factors is the concept of Substantial Gainful Activity (SGA). In this article, we will explore what SGA means, how it is determined, and its significance in disability determinations.

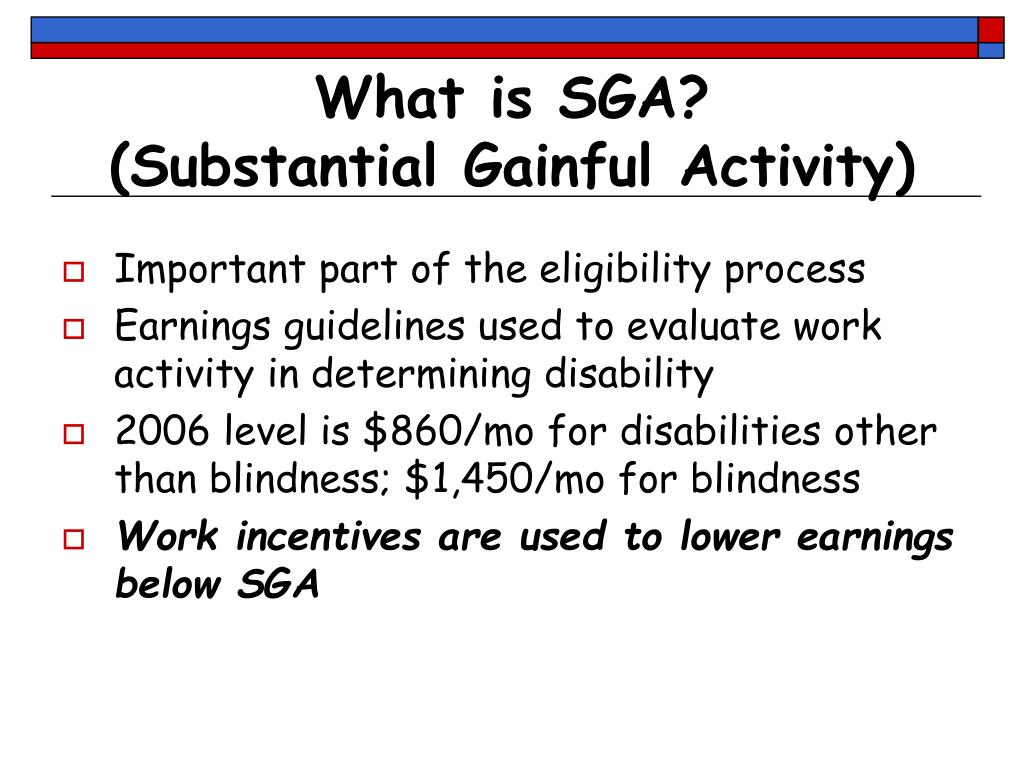

What is Substantial Gainful Activity (SGA)?

Substantial Gainful Activity refers to work that is substantial, meaning it involves significant physical or mental activities, and gainful, meaning it is done for pay or profit. The SSA considers SGA as any work that earns an individual a certain amount of money, which is adjusted annually. For 2022, the monthly SGA threshold is $1,350 for non-blind individuals and $2,260 for blind individuals.

How is SGA Determined?

The SSA uses a variety of factors to determine whether an individual's work activity is considered SGA. These factors include:

Gross earnings: The SSA looks at an individual's gross earnings from employment, which includes wages, salaries, and tips.

Work hours: The SSA considers the number of hours worked per week, with a minimum of 20 hours per week generally considered full-time.

Work duties: The SSA evaluates the physical and mental demands of an individual's job to determine if it is substantial.

Self-employment income: The SSA considers net earnings from self-employment, which includes income from a business or farm.

Significance of SGA in Disability Determinations

The determination of SGA is crucial in disability determinations because it helps the SSA decide whether an individual is capable of engaging in substantial work activity. If an individual's earnings exceed the SGA threshold, the SSA may consider them not disabled, even if they have a medical condition that limits their ability to work. On the other hand, if an individual's earnings are below the SGA threshold, the SSA may consider them disabled and eligible for benefits.

Impact of SGA on Disability Benefits

The SGA determination can have a significant impact on an individual's eligibility for disability benefits. If an individual is found to be engaging in SGA, they may be denied benefits or have their benefits terminated. However, if an individual is found not to be engaging in SGA, they may be eligible for benefits, including:

Disability Insurance Benefits (DIB): These benefits are available to individuals who have worked and paid Social Security taxes.

Supplemental Security Income (SSI): These benefits are available to individuals who are disabled, blind, or elderly and have limited income and resources.

In conclusion, the determination of Substantial Gainful Activity is a critical factor in disability determinations. Understanding what SGA means, how it is determined, and its significance in disability determinations can help individuals navigate the complex process of applying for disability benefits. If you or a loved one is applying for disability benefits, it is essential to consult with a qualified disability attorney to ensure that your rights are protected and that you receive the benefits you deserve.

By understanding the concept of SGA and its impact on disability determinations, individuals can better navigate the disability benefits process and ensure that they receive the support they need to live with dignity and independence.