As a business owner or freelancer, you're likely familiar with the importance of tax compliance and the various forms required to ensure you're meeting your tax obligations. One such form is the W-9, also known as the Request for Taxpayer Identification Number and Certification. In this article, we'll delve into the details of Form W-9, its purpose, and what you need to know about requesting and completing it.

What is Form W-9?

Form W-9 is a document used by businesses and other entities to provide their taxpayer identification number (TIN) to other companies, banks, and financial institutions. The TIN can be either a Social Security number (SSN) or an Employer Identification Number (EIN), depending on the type of business or individual. The form is used to certify the taxpayer identification number and to confirm that the individual or business is not subject to backup withholding.

Purpose of Form W-9

The primary purpose of Form W-9 is to provide a way for businesses and financial institutions to collect the necessary taxpayer identification information from their vendors, contractors, and other payees. This information is used to report income paid to these individuals or businesses on Form 1099-MISC, which is filed with the Internal Revenue Service (IRS).

Who Needs to Complete Form W-9?

Form W-9 is typically required for individuals and businesses that provide services or products to other companies, including:

Freelancers and independent contractors

Sole proprietors and single-member limited liability companies (LLCs)

Partnerships and multi-member LLCs

Corporations and S corporations

Tax-exempt organizations and trusts

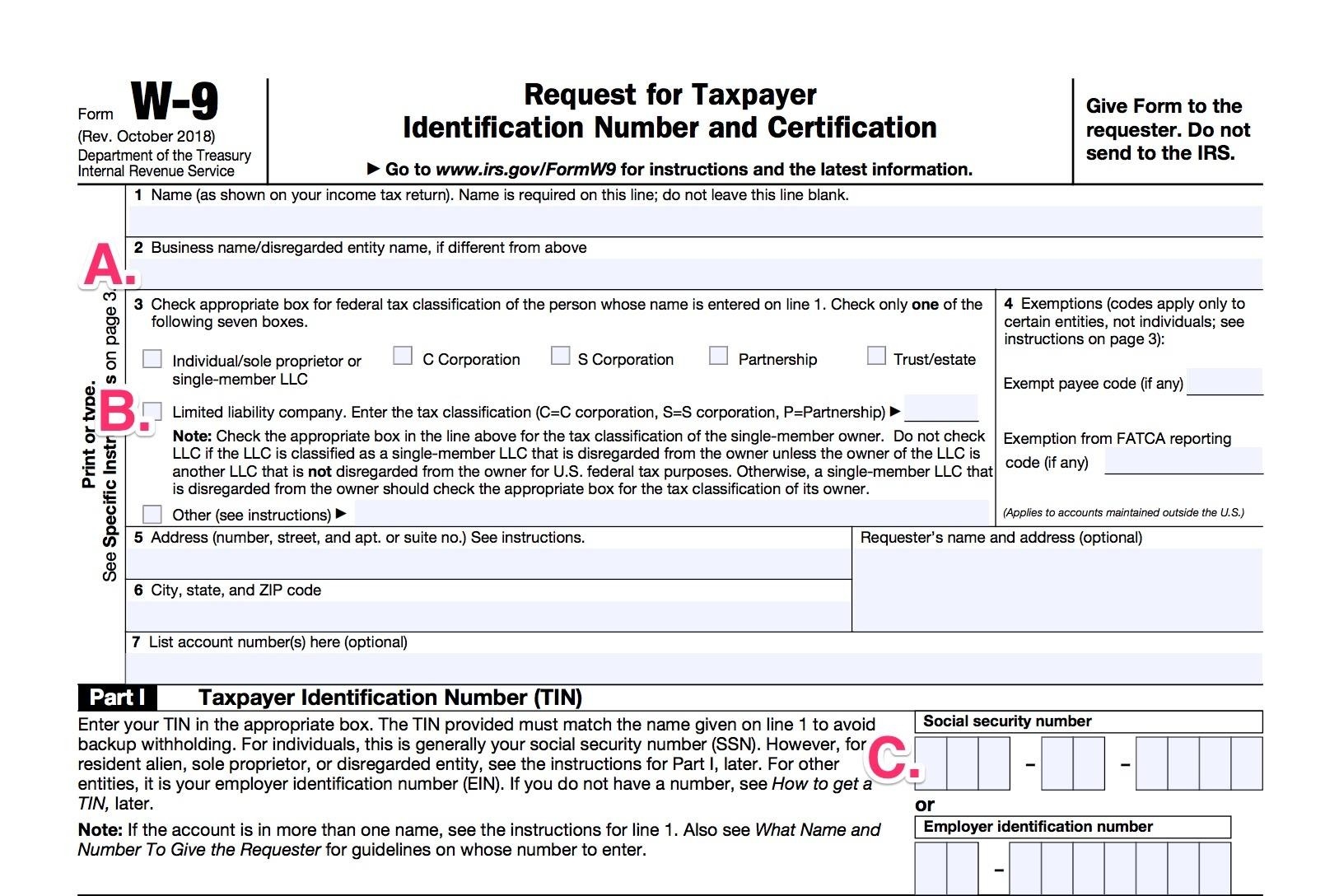

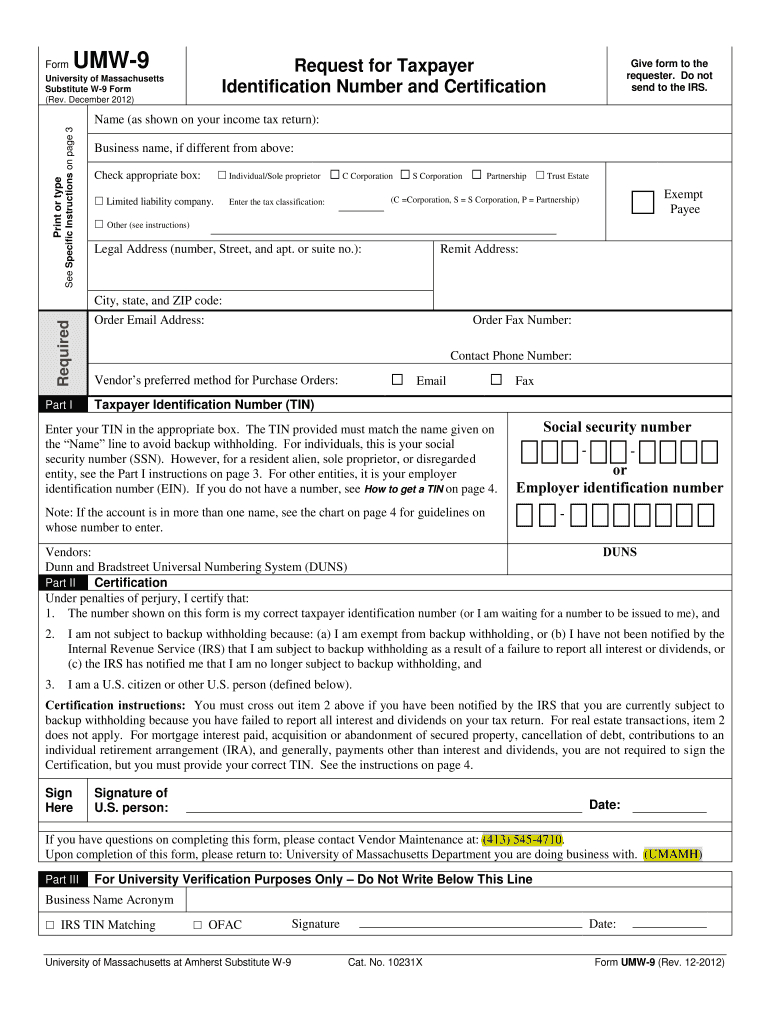

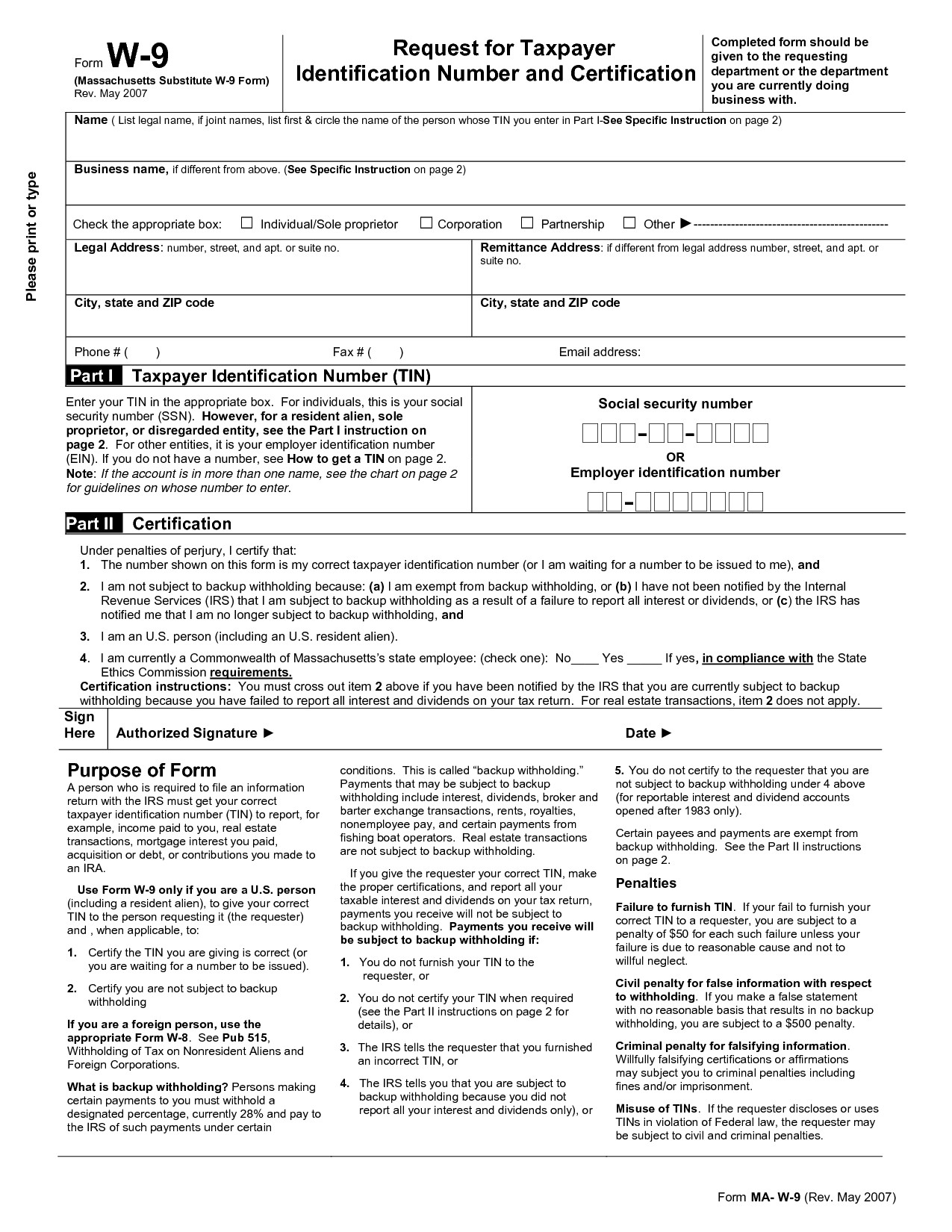

How to Complete Form W-9

Completing Form W-9 is relatively straightforward. The form requires the following information:

Business name and address

Taxpayer identification number (TIN)

Type of business entity (e.g., individual, corporation, partnership)

Certification that the TIN is correct and that the individual or business is not subject to backup withholding

It's essential to ensure that the information provided on the form is accurate and complete, as incorrect or incomplete information can lead to delays or penalties.

Consequences of Not Providing Form W-9

Failure to provide a completed Form W-9 can result in backup withholding, which means that the payer will withhold a portion of the payment and remit it to the IRS. This can lead to a reduction in the amount of payment received by the payee. Additionally, not providing a Form W-9 can also lead to penalties and fines imposed by the IRS.

In conclusion, Form W-9 is a crucial document for businesses and individuals to provide their taxpayer identification number and certification to other companies and financial institutions. Understanding the purpose and requirements of Form W-9 can help ensure tax compliance and avoid potential penalties. If you're unsure about how to complete Form W-9 or have questions about the process, it's always best to consult with a tax professional or accountant.

By following the guidelines outlined in this article, you'll be well on your way to ensuring that your business or individual tax obligations are met, and you'll avoid any potential issues related to Form W-9. Remember, tax compliance is an essential aspect of running a successful business, and staying informed about the necessary forms and requirements can save you time and money in the long run.