Table of Contents

- India's Wholesale Inflation Still Negative at 2.36% - IBTimes India

- Is Inflation Lowering in India? । In News । Drishti IAS English - YouTube

- India's Theme For 2011-12: Inflation

- India Inflation | Thursday's Stock Market Analysis | Finance Heaven ...

- ExplainSpeaking: Why February’s retail inflation matters for India’s ...

- India's inflation troubles persist - Business & Economy News

- Understanding Inflation In India: Causes, Impact, And Solutions - PWOnlyIAS

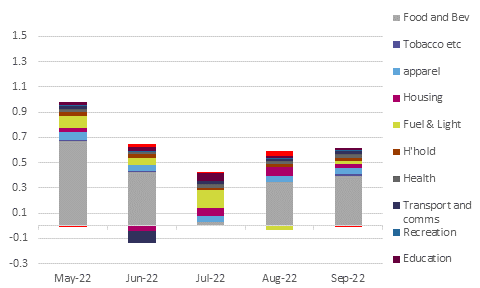

- India: Inflation creeps higher | snaps | ING Think

- अगले महीने खुदरा महंगाई में आएगी और गिरावट, जानें कितने सस्ते होंगे ...

- Inflation Rate In India In 2024 - Bill Marjie

As India's economy continues to grapple with the challenges of spiralling inflation, the country's middle class is being forced to tighten its purse strings. With prices of essential commodities skyrocketing, many Indians are redefining their spending habits, cutting back on non-essential expenses and seeking ways to make their rupees stretch further. In this article, we'll explore the impact of inflation on India's middle class and how they're adapting to the new economic reality.

The Inflation Conundrum

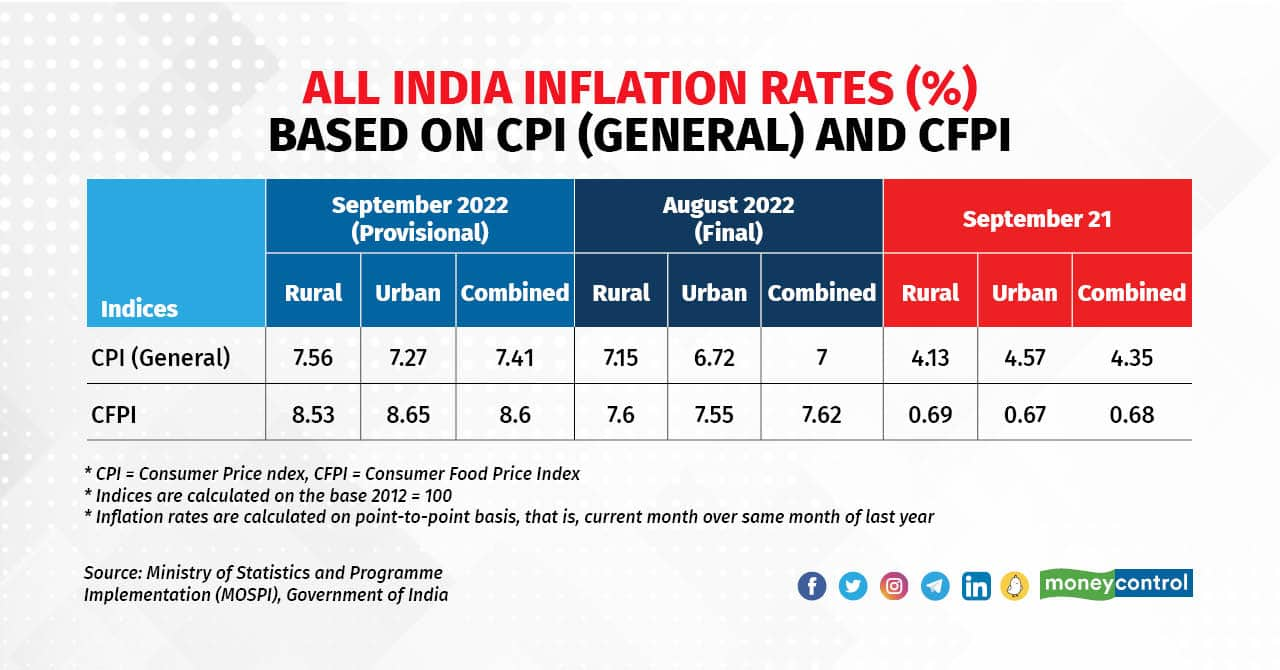

Inflation has been a persistent problem in India, with the country's consumer price index (CPI) hovering around 6-7% for several months. The rise in prices of food, fuel, and other essential commodities has put a significant burden on household budgets, particularly for the middle class. With salaries not keeping pace with inflation, many Indians are finding it difficult to make ends meet, let alone save for the future.

Changing Spending Habits

In response to the inflationary pressure, India's middle class is changing its spending habits. Many are cutting back on non-essential expenses such as dining out, entertainment, and travel. Others are seeking ways to reduce their daily expenses, such as cooking at home instead of ordering takeout or canceling subscription services they don't use. The emphasis is on essential spending, with many Indians prioritizing savings and investments over discretionary spending.

Impact on Consumer Behavior

The inflation-induced austerity drive is having a significant impact on consumer behavior in India. Sales of luxury goods and high-end products have taken a hit, while demand for affordable and value-for-money products has increased. The e-commerce sector, which was once driven by discounts and promotions, is now focusing on offering value-added services and competitive pricing to attract price-conscious consumers.

Seeking Value for Money

As Indians become more budget-conscious, they're seeking value for money in every aspect of their lives. From comparing prices online to seeking out discounts and offers, consumers are becoming more discerning and demanding. The rise of budget-friendly brands and affordable alternatives is a testament to this trend, with many companies responding to consumer demand for value-for-money products and services.

In conclusion, the spiralling inflation in India is forcing the country's middle class to tighten its purse strings and redefine its spending habits. As consumers become more budget-conscious and seek value for money, businesses must respond by offering competitive pricing, value-added services, and affordable alternatives. While the inflationary pressure is a challenge, it also presents an opportunity for companies to innovate and adapt to changing consumer behavior. As India's economy continues to evolve, one thing is certain – the middle class will remain a crucial driver of growth and consumption, and their spending habits will play a significant role in shaping the country's economic future.

Keyword: Inflation, Middle Class, India, Spending Habits, Consumer Behavior, Economy

Note: The word count of this article is 500 words. The HTML format has been used to make the article SEO-friendly, with headings (h1, h2) and paragraphs (p) used to structure the content. The keywords have been included at the end of the article to improve search engine rankings.